Investment Decision: Litigation Capital Management

High Returns on Capital Deployed With Significant Growth Ahead

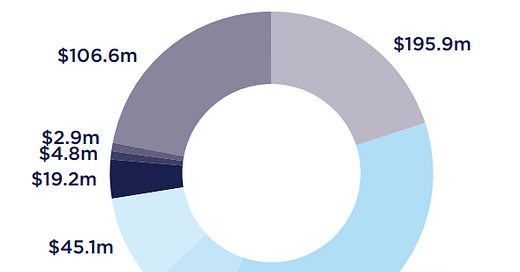

Litigation Capital Management is an alternative investment manager. They invest their own balance sheet and third-party funds in different classes of litigation. Here’s a 2023 view of the litigation portfolio by type:

Source: 2023 Annual Report

So far, these investments have yielded some quite incredible returns:

Source: 2023 Annual Report

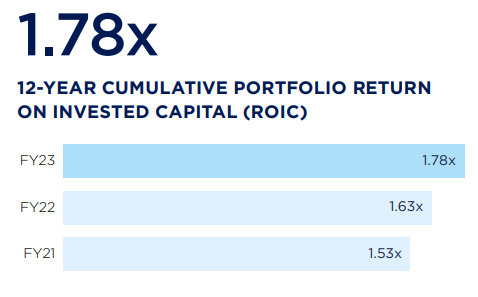

Yes, these are actual IRRs and not the optimistic projections made by CFOs with significantly distorted errors. They also report Return on Invested Capital of the funds that are used to finance litigation:

Source: 2023 Annual Report

As they scale, I expect these numbers to tighten up a little, but they are still outstanding. By comparison, Burford Capital reports an IRR close to 30%.

2023 - Scale Begins to Impacts Results

2023 was a transformational year as resolutions from Fund I, which was closed in March 2020, started to materialise. Note that LCM co-invests from their balance sheet with their managed Funds. Investments are split 25% LCM / 75% Fund. They earn 25% performance fees over an 8% soft hurdle rate. This increases to 35% for investments that exceed a 20% IRR.

LCM cash generated from the resolution of matters during the period was $96.8 million, as compared to $26.6 million in FY22 - 2023 Annual Report

Source: 2023 Annual Report

This is an LCM-only view, i.e., exclusive of third-party funds. The most important aspects of this breakdown are:

A$96.8 million in cash has come into the business from resolutions of litigation investments. 2022 saw A$26.6 million, which was a little down on the previous year, probably due to COVID-19 court delays. 2021 saw A$37.5 million in settlement. So this is 2.6 x 2021 settlements.

A$36.3 million has been reinvested in future litigation projects from LCM’s balance sheet. 2022 saw A$29.8 million invested, and 2021 was A$47.6 million. Investments can be lumpy, it depends on the capital requirements of the litigation.

I expect some of this increase in settlements was due to the unclogging of the legal system due to COVID-19 shutdowns. Taking a 3-year average yields A$54.6 million in settlement vs. a A$31.6 million 3-year average for 2022. Or, if we assume 2022 rose by 22% rather than declining (22% is the 2021 increase over 2020), then 2023 would have been A$77.7 million. Still significant growth.

LCM ended the year with A$83 million in cash on the balance sheet. Why the big cash balance? I assume this is capital that will be used to invest alongside Fund II. Given that Fund II raised A$290 million and they will continue to invest alongside Fund I, they will need plenty of cash for capital deployments. They are also considering a bond issue to raise additional capital as an alternative source of investment assets.

LCM quotes a resolution maturity time of 27 months. Looking back at total Assets Under Management (LCM balance sheet + funds) 27 months ago, we see approximately A$300 million (A$250 million in 2020 and A$336 million in 2021). Total AUM are likely to grow in excess of A$1 billion in 2 to 3 years; 2023 came in at A$500 million. I’d expect we could see settlements perhaps 2 to 4 times greater than the 3-year average in 3 to 5 years, or A$109 million to A$218 million, more likely the latter.

Revenue and Earnings Bumps

It’s incredibly important to understand that the revenue and underlying profitability of this company cannot be viewed from year to year. You must take a multi-year view due to the unpredictability of litigation. Scale will smooth this out a bit, but it could be possible for LCM to report a drop in revenue one year due to a revaluation of their portfolio as a result of some court decision or regulatory impact. They could also have cash flow issues where settlement is pushed back due to delays in the court system. They may win an award where they can only collect a fraction or get paid in installments over time. By pure chance, several negative judgements could even arrive in the same year. They could also win several big settlements in the same year, giving an artificial boost to revenue. Expect some bumps on this journey! It’s so important to stay rational in this business. Focus largely on deployed capital and cash received from settlement over the past 3 years.

Fair Value Accounting

LCM recently switched to Fair Value Accounting, something they had been reluctant to do in the past, but they believe scale has pushed them in this direction:

LCM continues to debate and seek professional expert advice with respect to applicable standards. It may be the case that, as LCM’s business continues to grow, the appropriate and applicable standard to apply to our business model may be IFRS 9 and fair value accounting. If LCM were to adopt this accounting standard, it would be alongside cash accounting numbers, and we would only adopt a method of fair valuation that can be scrutinised through a transparent publicly available policy that would provide investors with full disclosure.

A key point here is the continuation of cash accounting for transparency, which is very fair (pun intended!).

I liked the brutal honesty of cash accounting but appreciate that it doesn’t necessarily reflect the underlying value of investments in litigation, especially when key case milestones are reached. Having said that, I’ll largely ignore the fair value of investments and associated revenue and continue to focus on real cash deployed and received into the business vs. cost of capital.

This change in accounting should be a catalyst for the stock in the coming years. As revenue rises due to significantly increased assets under management, this will smooth the revenue and profit curves, attracting other investors. Although Burford Capital got scythed down by Muddy Waters for some apparently dubious practices, which we should be cautious of, I have far greater confidence in LCM than I do in Burford.

Key Shareholders

Source: SimplyWall.St

The top two shareholders are the Chairman and CEO! It’s great to see such a significant holding from the CEO, who has also invested his personal capital into the business (~435k shares over the past 3 years). Additionally, Jonathan Moulds has invested a not-insignificant sum into the business over the past 3 years. Very encouraging. Jonathan Moulds is also a non-executive independent director with IG Group, another great business.

Also note that LCM is largely owned by the general public and individual investors, with very little institutional buy-in.

Source: SimplyWall.St

This is a unique early advantage: getting in ahead of funds. As they grow in size and the market gains confidence, expect funds to buy in, creating upward pressure on price.

Operating Expenses

Since 2020, operating expenses have doubled, whereas cash from settlements has trebled. This is a force multiplier for LCM; you have to bear in mind that investments in operating expenses today yield returns 2-3 years in the future. While it’s reassuring to see growth in settlements outpace expenses, you have to consider that operating expenses should only continue to grow with additional capital that requires deployment. Expect settlements and expenses to continue to diverge, with expenses becoming an increasingly smaller percentage of gross profit.

Dividends and Share Buybacks

LCM has paid dividends in the past and recently paid out around 2.25%. They also issued a share buyback for around 4.5% of the outstanding share capital. Given their RoIC and IRR, I’m not sure either of these make any sense, but I appreciate they are trying to attract a broader investment community to bolster the share price. Any promotional activity or broader awareness should be favourable when it comes to issuing debt or raising funds in the future.

Summary

LCM is taking a giant leap in scale. They are just starting to reap the rewards of A$150 million invested through Fund I, with A$290 million from Fund II being deployed over the coming years. They are also planning to raise another A$450 million through Fund III and a potential capital raise through the debt markets. Even taking a 3-year average across cash received from settlements, we could be looking at more than A$200 in settlements in 3-5 years time as they continue to reinvest cash generated by those settlements. By contrast, you can buy this business for about A$210 million today. This is a future A$2 billion+ market cap business, or 4-5 x current market value (in GBP), which is 32% CAGR in share price alone over 5 years, excluding dividends. With institutional investors yet to buy in, I believe I have a significant margin of error on this one.

I am confused about the 12 year cumulative rate of return. Burford states like 30% annualized. Here it is cumulative? Does it mean the 78% return is stretched over 12 years? (which would be significantly lower than Burford)? Or am I completely off here?